Contact Us

The U.S. IT industry is undergoing a transformative phase. Emerging cities are quickly becoming more well-known, even while older IT hubs still have a big impact. The adoption of remote work, cost of living factors, and local government incentives all have an impact on this change. Understanding these dynamics is crucial for organizations aiming to optimize talent acquisition strategies.

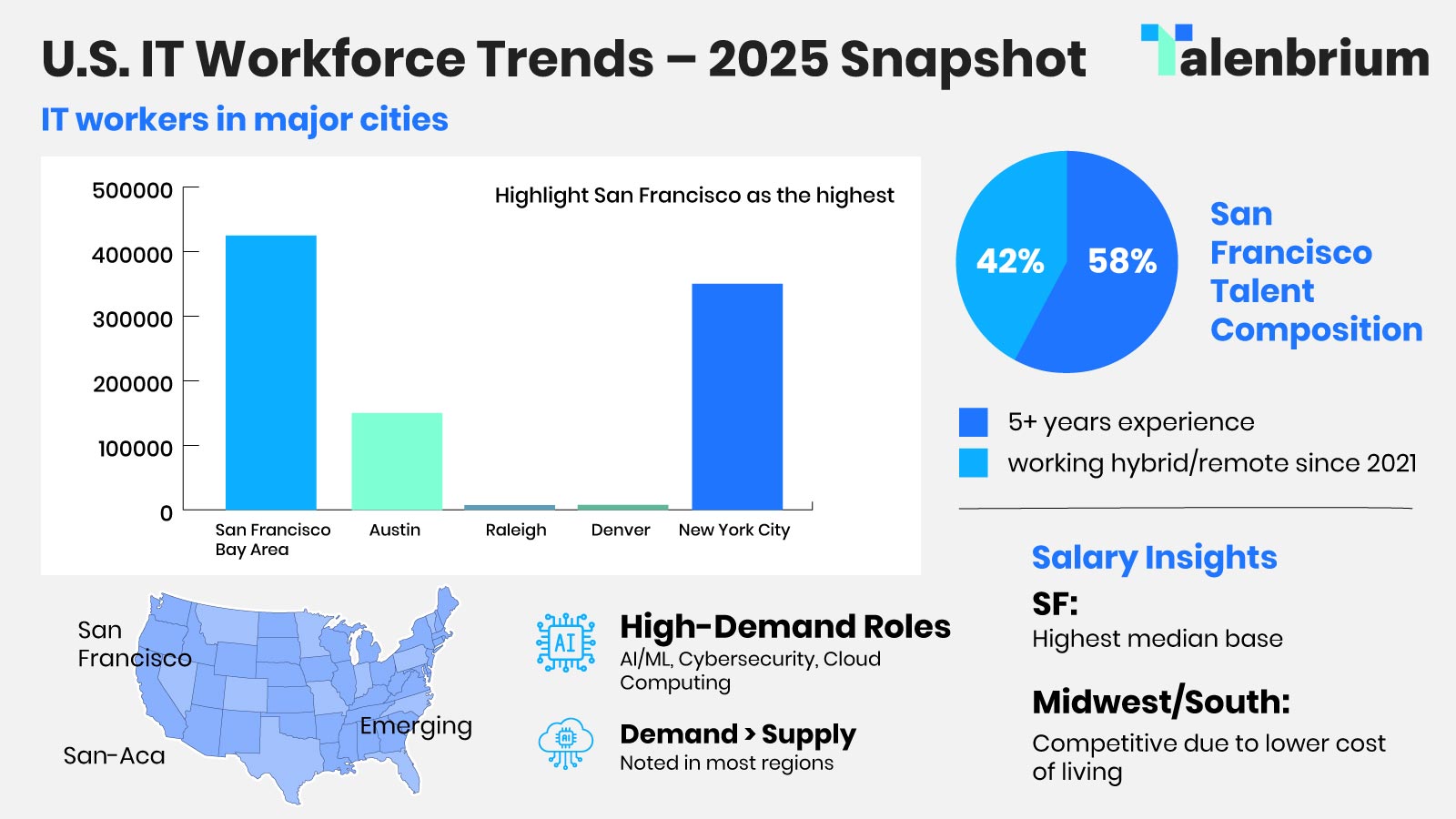

Despite widespread narratives around tech exodus, the San Francisco Bay Area remains home to the most concentrated and experienced pool of IT professionals in the United States. As of early 2025, the region accounts for an estimated 425,000 active IT workers, with a significant share employed in advanced roles spanning platform architecture, AI/ML engineering, and backend systems development. Over 58% of the talent base holds more than five years of experience, and approximately 42% have transitioned to hybrid or fully remote roles since 2021.

The talent supply here is robust in cloud-native technologies, full-stack development, and data engineering, bolstered by elite universities such as Stanford and UC Berkeley, which together graduate over 5,000 computer science and related majors annually. However, the region has experienced a measurable reduction in junior-level hiring velocity, partly attributed to high entry costs and shifting lifestyle preferences among early-career professionals.

Immigration constraints, particularly H-1B cap limits and long processing times, have impacted the international pipeline — once a defining feature of Silicon Valley's global competitiveness. Yet, San Francisco still maintains a deep bench of technical specialists and attracts top-tier mid- to senior-level talent willing to absorb premium living costs in exchange for career acceleration.

Austin has rapidly evolved from a secondary tech hub to a mainstream contender, with an estimated IT workforce exceeding 150,000 as of Q1 2025. The city's talent base has grown by more than 18% in the past three years, driven by corporate relocations, including high-profile moves from Tesla, Oracle, and several Bay Area startups seeking operational scale at a lower burn rate.

With almost 48% of employees having less than five years of experience, Austin's IT talent pool is comparatively younger, fostering an agile and learning-oriented environment. DevOps, cybersecurity, and mobile development are prominent skill concentrations, and an increasing percentage of engineers are now concentrating on edge computing and blockchain.

The University of Texas at Austin produces nearly 3,500 CS and IT graduates annually, many of whom are absorbed directly into local employers or regional startup ecosystems. Coding boot camps and non-traditional education programs have also created a vibrant re-skilling market, particularly for underrepresented groups.

The influx of talent from California and New York — facilitated by flexible remote work policies — has reshaped Austin's talent landscape. While the city still struggles to match the depth of senior technical expertise found in older hubs, it excels in attracting motivated, multi-skilled professionals who thrive in fast-paced, scale-up environments.

With a labor force of more than 350,000 IT professionals, New York City remains one of the country's most diverse and densely packed technology markets. Unlike San Francisco or Austin, NYC's tech ecosystem spans multiple industries — including finance, media, healthcare, and real estate — resulting in a highly interdisciplinary workforce.

Talent supply is strongest in backend development, data analytics, product management, and, increasingly, cloud security. Major universities such as Columbia, NYU, and Cornell Tech produce a steady flow of high-quality graduates, while a robust set of coding boot camps and training institutions adds roughly 6,000 job-ready candidates per year to the junior pipeline.

Despite a modest outflow of tech talent during the pandemic, New York's workforce rebounded in 2023 and 2024, driven partly by increased hybrid arrangements and financial institutions investing in proprietary tech stacks. Today, over 64% of NYC's IT professionals work in hybrid or flex-office environments, making it one of the country's most adaptive tech labor markets.

The city also stands out for its strong representation of women (33%) and ethnic minorities (41%) in tech roles — among the highest nationally — a testament to concerted diversity hiring initiatives and partnerships with organizations focused on equity in STEM.

While talent supply is becoming more geographically distributed, IT job demand in the U.S. remains uneven, with certain cities and skill domains experiencing extreme hiring pressure. The surge in AI/ML adoption, cloud migrations, cybersecurity threats, and enterprise software transformation has created dense pockets of demand that far exceed local talent capacity — especially at the mid-to-senior level.

Nationwide, job postings for IT roles rose 11.4% year-over-year as of Q1 2025 despite broader macroeconomic tightening. Interestingly, hiring rebounds have been sharper in non-traditional markets, where employer competition remains low and workforce growth potential remains untapped.

Despite a 15% decline in job postings from its 2021 peak, San Francisco continues to experience high-density hiring activity, particularly in niche roles. The demand-supply ratio in AI/ML, backend architecture, and cloud reliability engineering exceeds 2.3:1, making senior technical talent highly competitive.

Startups in Series B and later stages are driving most of the demand, while more prominent players like Google, Meta, and Salesforce have moved toward consolidation and optimization of headcount. That said, the area still produces the highest volume of open tech roles per capita in the country, particularly in AI infrastructure and developer tooling.

Austin's tech job demand has outpaced local talent growth by nearly 22%, making it one of the hottest hiring markets in the U.S. Much of this demand is concentrated in DevOps, infrastructure engineering, and cybersecurity, reflecting the city's new positioning as an operational tech hub.

The demand pressure ratio sits at 2.1:1, driven by the growth of mid-sized companies and decentralized teams building outside of Silicon Valley. Companies are also beginning to compete with remote-first firms recruiting nationally, adding further strain to local availability.

While junior-level roles attract broad applicant pools, experienced hires—especially in systems design and cloud architecture—remain scarce and expensive to secure.

New York exhibits a more stable and structured demand environment, with financial institutions, healthcare systems, and retail platforms driving consistent demand for backend, cloud security, and full-stack roles.

Unlike Austin or SF, NYC has a balanced demand-supply ratio of approximately 1.4:1, meaning most roles are filled within a 30–45-day window. However, senior cloud and security engineers still face hiring delays due to limited availability.

FinTech startups and SaaS firms have added new layers of demand in the past 18 months, with companies like Ramp, Alloy, and Vise leading aggressive tech hiring campaigns. Hybrid work policies in this region have also stabilized retention and slowed outbound migration.

Atlanta is quickly becoming the Southeast's tech hiring epicenter, with demand rising, particularly in data engineering, cloud DevOps, and AI/ML roles. The city benefits from proximity to multiple universities (Georgia Tech, Emory), and generous tax incentives for tech companies.

As of early 2025, Atlanta's demand-supply ratio is the second highest nationally at 2.5:1, and time-to-fill for niche roles like MLOps engineers and AI product managers exceeds 60 days on average. Mid-market employers are especially active as they compete with more prominent brands entering the region post-relocation.

Seattle's job market is undergoing a post-consolidation recovery. After layoffs across Amazon, Microsoft, and other cloud players in 2023, hiring activity is rebounding — particularly in cloud services, internal developer platforms, and compliance tech.

Demand pressure is moderate (1.6:1), and the market is showing healthier signs of balance than most coastal cities. The presence of high-level engineering talent and an adaptive hybrid culture makes Seattle a consistent choice for global tech expansions, particularly from Asian and European firms setting up North American engineering hubs.

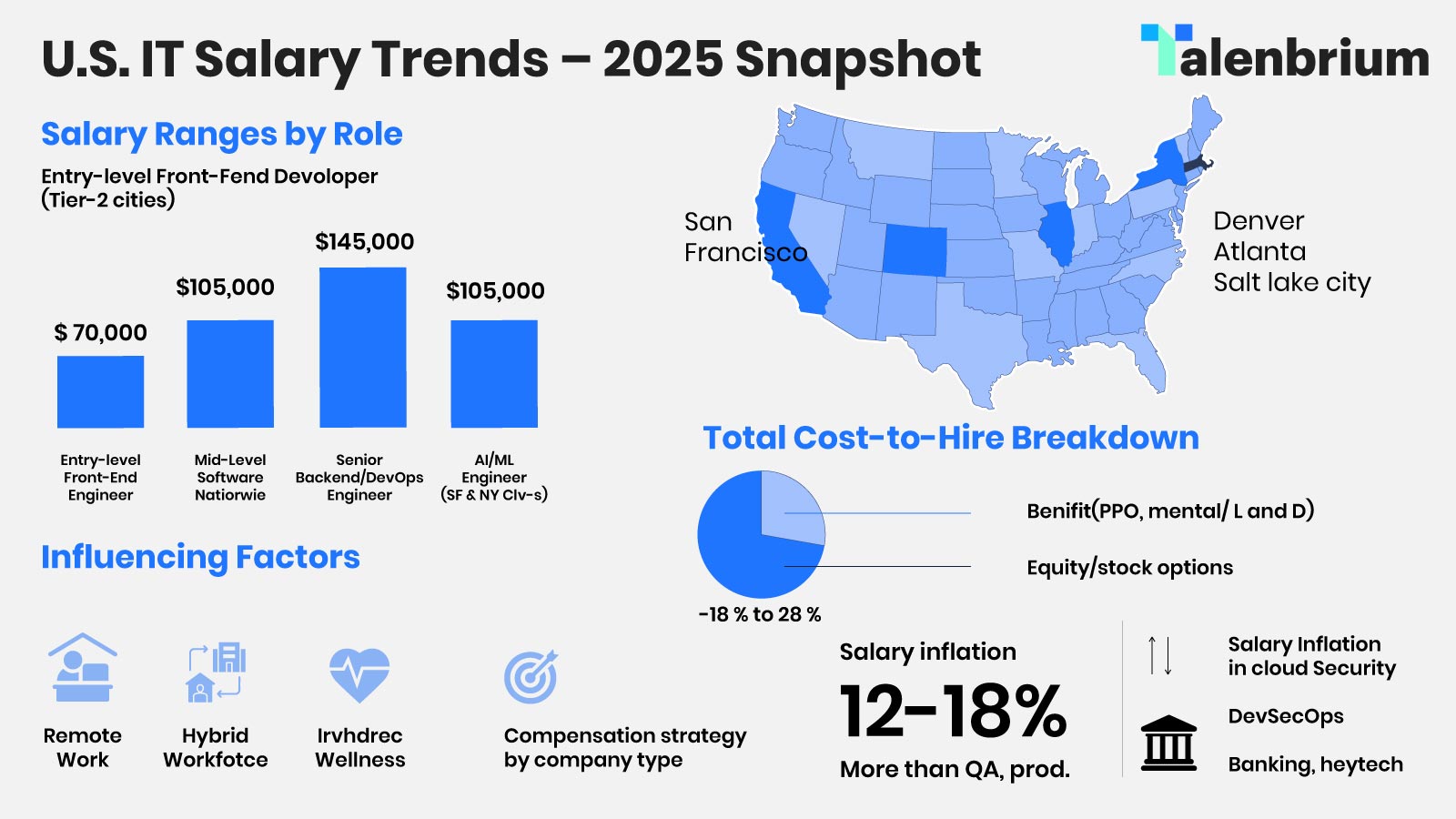

Salary dynamics in the U.S. IT sector have undergone a recalibration phase since the hyperinflated compensation peaks of 2021–2022. As of 2025, base salaries across most job functions have stabilized, with moderate YoY increases in select geographies and niche skills. The reset has created more predictable benchmarks — though cost-to-hire continues to vary widely by city, company size, and remote policy.

Nationwide, mid-level software engineers earn between $105,000 and $135,000, while senior backend and DevOps roles routinely command $145,000 to $185,000, depending on location and domain expertise. AI/ML engineers remain at the top of the pay scale, with base salaries starting at $165,000 and stretching up to $220,000+ in San Francisco and New York for experienced profiles. Conversely, entry-level front-end developers in Tier-2 cities earn between $70,000 and $85,000.

Remote work continues to influence compensation planning. Companies that maintain location-agnostic salary bands — often mid-stage startups or cloud-native enterprises — contribute to market wage normalization. Conversely, firms adjusting for cost-of-living still maintain premium pay scales for talent based in the Bay Area, Seattle, or Manhattan.

However, base salary is only one piece of the total cost equation. The total cost-to-hire—including benefits, stock options, recruitment overhead, employer-side taxes, and onboarding—adds between 18% and 28% on average. Cities like San Francisco and New York still carry the highest total cost burden, mainly due to equity-heavy compensation models, retention bonuses, and housing-related allowances. In contrast, employers in cities like Denver, Atlanta, and Salt Lake City benefit from 20–30% lower compensation footprints for similar profiles.

Healthcare costs and benefit expectations also shape the cost equation. In tech-forward markets, offering comprehensive PPO health plans, mental health stipends, L&D budgets, and flexible PTO policies is now standard. Remote and hybrid candidates, particularly in high-pressure roles, increasingly expect wellness support, performance-linked bonuses, and equity participation — even from non-tech employers.

Across industries, engineering salaries outpace product, QA, and data analysis roles by 12–18%, while demand for cloud security and DevSecOps talent has led to sharp salary inflation in regulated sectors like banking, healthcare, and government technology.

In summary, the U.S. tech salary landscape is entering a more sustainable, strategic phase — driven by role scarcity, regional competition, and evolving workforce expectations. Employers that localize compensation strategies while preserving long-term value incentives are emerging as more resilient in attraction and retention.

Across the U.S., several IT roles consistently dominate job postings and headcount expansion plans, reflecting the ongoing acceleration of cloud adoption, AI integration, and cybersecurity resilience. While demand volume is highest in large metro hubs like San Francisco, New York, and Seattle, relative pressure is often more intense in emerging markets such as Austin and Atlanta — where talent pools are narrow, yet expectations are rising.

Software engineers, particularly those working on backend systems in languages like Python, Java, or Go, remain the bedrock of digital infrastructure hiring. In San Francisco, senior backend engineers command a median base salary of $160,000, while the same roles in Austin and Atlanta range between $130,000 and $140,000, reflecting regional cost adjustments.

Cloud engineers and solutions architects are among the most scarce and highly compensated professionals in 2025. In Seattle — home to AWS and a mature cloud-native ecosystem — cloud engineers earn a median base of $155,000, while in Denver and Salt Lake City, where cloud teams are scaling rapidly, the median is closer to $135,000–$140,000. Demand for multi-cloud proficiency (AWS + GCP or Azure) adds a 12–15% premium.

Cybersecurity analysts and DevSecOps professionals are increasingly important, particularly in New York and Washington, D.C., where regulated industries (finance, healthcare, government) dominate IT investment. In New York, a mid-level cybersecurity engineer earns around $145,000, with senior specialists exceeding $175,000. Atlanta and Dallas — rising security hubs — report median salaries in the $125,000–$135,000 range, yet often compete fiercely due to role scarcity.

Data engineers and AI/ML specialists are the most stretched roles nationally. Senior machine learning engineers now average over $185,000 in base compensation in San Francisco and Boston, often with substantial equity upside. Entry-to-mid-level data engineers in Raleigh and Chicago earn around $115,000–$125,000, while top-end roles in cities like San Jose surpass $160,000.

Other roles, such as front-end developers (React/Next.js), mobile app engineers, and QA automation specialists, show healthy but more regionally stable demand. Median front-end salaries range from $110,000 in Chicago to $135,000 in Seattle, depending on stack complexity and seniority.

Overall, the U.S. tech salary landscape reflects a convergence of specialization and localization—roles tied to AI, cloud, and security command premiums everywhere. However, the gap between coastal and non-coastal cities continues to narrow due to remote hiring, wage parity trends, and growing technical maturity in Tier-2 markets.

Across the United States, the nature of IT job demand in 2025 is being shaped not just by the scale of companies but by their digital ambition, business model evolution, and the maturity of their internal tech organizations. While Big Tech continues to dominate in terms of absolute volume, a growing share of hiring momentum is coming from non-tech companies investing in proprietary platforms, as well as mid-cap SaaS and fintech scale-ups that are expanding nationally.

In San Francisco, despite a hiring slowdown from legacy Big Tech players, firms like OpenAI, Anthropic, Stripe, and Databricks have ramped up hiring significantly, particularly for AI/ML engineers, platform architects, and data infrastructure roles. Stripe has focused on growing its developer experience teams, while Databricks is absorbing a disproportionate number of cloud-native engineers due to its Lakehouse platform expansion. Even Meta and Google, though quieter in volume, continue to drive niche hiring in AR/VR, AI safety, and internal tooling.

Austin's tech economy has shifted from reliance on legacy employers like Dell and IBM to a hybrid hiring landscape where Tesla, Oracle, Indeed, and Bumble now dominate tech postings. Oracle, in particular, increased backend and cloud developer recruitment in Q1 2025 as it continues transitioning customers to its Gen2 cloud. Meanwhile, Tesla has fueled hiring in embedded systems, software QA, and real-time data streaming—a crossover between traditional automotive engineering and modern IT operations.

In New York City, job demand is influenced by financial services and rapidly scaling fintech firms. JPMorgan Chase, Goldman Sachs, Morgan Stanley, and newer disruptors like Ramp, Varo, and Alloy are driving demand for roles in cloud security, data compliance engineering, and backend services. JPMorgan's internal hiring for its AI Research Lab has also triggered demand for ML Ops professionals and Python-heavy backend engineers, while companies like Vise and Alloy are competing for front-end engineers with fintech UX experience.

Atlanta's surge in IT hiring is consequential to a new wave of digital transformation initiatives from Fortune 1000 enterprises. Companies like Coca-Cola, Delta Air Lines, NCR, and Home Depot are investing heavily in internal engineering teams to modernize supply chain infrastructure, customer data platforms, and AI-driven personalization engines. NCR's relocation of product and engineering functions to Atlanta has created new demand for full-stack developers and DevSecOps professionals, while Delta has expanded recruitment for software engineers specializing in logistics and fleet data optimization.

Meanwhile, Seattle's job demand continues to be steered by Microsoft and Amazon, although hiring has become more targeted and ROI-driven since 2023. Microsoft is hiring aggressively for Copilot engineering teams, cybersecurity automation, and internal developer platform roles. While reducing headcount in some non-core tech divisions, Amazon has expanded hiring in AWS cloud services — particularly for enterprise solution architects and customer-facing DevOps roles. Outside the Big Two, companies like Tableau (Salesforce), Zillow, and Convoy are critical in the demand for data visualization engineers and platform SREs.

A notable trend across these cities is the growing demand from non-tech enterprises — especially in healthcare (e.g., CVS Health, UnitedHealth), retail (Walmart Global Tech), and manufacturing (GE Digital, Honeywell). These firms are no longer simply outsourcing their IT — they are building internal, full-stack product teams, and their hiring is beginning to rival traditional SaaS companies in speed and sophistication.

In summary, job demand in 2025 is no longer the sole domain of Silicon Valley's elite. Across the U.S., hiring is being driven by a blend of product-focused fintech, AI-native startups, digital arms of legacy enterprises, and mission-critical infrastructure platforms. This diversification is not just expanding the volume of jobs—it's redefining the playbook for how and where the most strategic IT teams are being built.

As compensation becomes more nuanced and candidate expectations evolve, benefits have taken centre stage in the competition for IT talent. In 2025, top tech employers are no longer simply differentiating on salary — they're building holistic reward frameworks that reflect lifestyle flexibility, professional growth, and long-term wealth creation.

Equity remains a core component of total compensation in San Francisco, particularly among late-stage startups and public tech companies. Stripe, Databricks, and Notion offer performance-linked equity refreshers, early liquidity windows, and access to company-wide growth bonuses. Stock-based compensation now accounts for 25–40% of total packages at the mid-to-senior level. Additionally, mental health stipends, fertility benefits, and home office setups have become standard, as the Bay Area workforce prioritizes stability and well-being in a post-hypergrowth environment.

In Austin, benefits focus on lifestyle alignment and professional mobility. Oracle, Tesla, and Indeed all offer comprehensive relocation assistance, extended parental leave (up to 20 weeks fully paid), and quarterly performance bonuses for engineering teams. Startups are offering flexible PTO with minimum mandatory leave, on-demand wellness stipends, and tech education budgets of $2,000–$3,000 per employee annually. The combination of affordable housing and employer-backed flexibility is making Austin an attractive retention market.

New York-based employers emphasize stability, progression, and long-term value creation, particularly in finance and enterprise SaaS. Companies like JPMorgan, MongoDB, and Bloomberg offer 401(k) matching up to 6%, unlimited sick days, and guaranteed annual raises. Mentorship-driven L&D programs are a standout feature here, with multiple firms allocating up to 5% of total HR budgets toward upskilling initiatives tied to career mobility. Financial wellness programs and sabbatical opportunities are also gaining traction — especially among mid-career engineers.

The fastest-rising benefit trend in Atlanta is around hybrid flexibility and community impact. Home Depot and NCR provide volunteer day credits, mental wellness leave, and employee referral bonuses of up to $10,000 for tech roles. Equity is less common but is increasingly offered by tech-forward players such as Mailchimp and Calendly. Onsite childcare, company-funded certifications, and student loan assistance are becoming standard components of mid-market and enterprise benefit portfolios.

In Seattle, Microsoft and Amazon have long set the bar for structured benefits — including RSUs, executive coaching, and 24/7 health concierge services. In 2025, this expanded to include AI career reskilling, internal rotation programs across product lines, and company-sponsored relocation to lower-cost cities with retention incentives. Salesforce, Tableau, and Zillow also push boundaries in flexible mental health access, funding platforms like Spring Health and Modern Health as part of EAP (Employee Assistance Programs).

A unifying trend across all top cities is the emergence of purpose-aligned perks. Candidates expect their benefits to reflect a company's culture and social commitments. Sustainability budgets (carbon offset reimbursements), DEI performance bonuses, and financial equity review transparency are becoming part of the benefits conversation — especially among younger tech professionals.

In today's hiring environment, benefits are no longer a checklist. They are a strategic signalling tool, helping companies convey values, drive retention, and compete for high-caliber talent across increasingly distributed geographies.

Diversity remains one of the most visible — and measured — indicators of inclusion maturity across the U.S. tech sector. In 2025, while representation is improving across most markets, the pace of change is inconsistent, with sharp contrasts between cities, company types, and job levels.

Nationally, women hold approximately 29% of technical roles, up from 25% in 2020. Ethnic diversity has also seen modest gains: Black and Hispanic professionals now represent ~16% of the IT workforce, although they remain significantly underrepresented in leadership and engineering-heavy functions.

In New York City, the most diverse U.S. tech market, women account for 33% of tech roles, with robust representation in data analytics, product management, and front-end development. Ethnic diversity is also highest here: nearly 42% of the tech workforce identifies as non-white, driven by structured DEI pipelines from employers like JPMorgan Chase, Google NYC, and Salesforce. Columbia University's Bridge to Tech program and NYU's inclusion accelerator have contributed to strong mid-career mobility for underrepresented talent.

San Francisco, historically less diverse in senior technical roles, has shown marked improvement post-2022. Companies like Airbnb, Stripe, and Notion have instituted leadership diversity scorecards, tying DEI goals to manager performance reviews. Women currently occupy 28% of technical positions, and ethnic minorities comprise 37% of the workforce, though representation drops to 19% at the engineering manager level and above. Several organizations now use anonymized resume filtering and structured interviews to eliminate first-level bias.

In Seattle, the influence of Microsoft and Amazon has driven systematic inclusion efforts — both companies publish annual DEI transparency reports and have internal mobility programs for women in cloud infrastructure and cybersecurity. As of Q1 2025, female tech participation stands at 31%, with Microsoft surpassing its 2024 target of 35% women in software roles in its U.S. operations. Ethnic diversity in Seattle remains moderate at 29%, though it is rising among entry-level and associate engineers due to internships and early-career rotational programs.

Austin lags in leadership-level diversity metrics but shows promise in junior hiring. Women account for 26% of technical roles, and non-white professionals comprise 34% of the city's IT workforce, partly led by Dell, IBM, and Oracle's ongoing regional DEI hiring mandates. Community colleges and boot camps have become key feeders for underrepresented groups entering QA, support engineering, and DevOps roles. Startups are beginning to embed diversity metrics into investor reporting, signaling a culture shift at the ecosystem level.

Atlanta, by contrast, is emerging as a national leader in ethnic diversity. With nearly 45% of IT professionals identifying as Black or Hispanic, the city benefits from strong local universities (Spelman, Morehouse, Georgia Tech) and a corporate landscape increasingly focused on racial equity. Companies like Mailchimp, NCR, and Coca-Cola Tech have prioritized supplier diversity, employee resource group funding, and community coding boot camp sponsorships to attract diverse tech talent. Gender diversity is also improving, with women holding 31% of tech roles, above the national average.

Beyond talent supply and demand, employers are increasingly factoring in macroeconomic conditions, regulatory environments, and local policy infrastructure when making decisions about tech hiring hubs. These variables directly impact hiring velocity, cost-to-scale, and long-term retention.

In 2025, the United States ranks 6th globally in overall ease of doing business, bolstered by improvements in digital infrastructure, IP protection, and labor mobility. However, these strengths are not evenly distributed across states and cities — creating distinct regional advantages for talent strategy planning.

Texas remains a favored destination for enterprise tech expansion due to its low corporate tax environment, lack of state income tax, and active government support for innovation districts. Austin, in particular, benefits from R&D credits, streamlined business registration, and public-private partnerships focused on digital skilling. Employers also enjoy greater flexibility in contractor hiring and relocation incentives, particularly for international transfers under the NAFTA TN visa program.

Florida, Utah, and North Carolina have also climbed the rankings for ease of hiring and workforce setup, primarily due to business-friendly regulatory frameworks and low employer-side costs. Cities like Miami, Salt Lake City, and Raleigh now rival traditional hubs in setting up regional tech delivery centers, especially for mid-cap companies looking to optimize cost structures without compromising talent quality.

Conversely, while still dominant in raw talent supply and innovation density, California and New York remain high-cost hiring environments due to layered taxation, complex employment law, and limited housing affordability in urban centers. San Francisco, for example, carries a 35–40% higher total cost of workforce acquisition compared to Austin or Denver when accounting for base salary, taxes, benefits, and retention packages. However, these states offset regulatory challenges with access to elite talent, venture ecosystems, and deep technical leadership pools.

Immigration continues to play a pivotal role in shaping tech labor markets. While federal policy around H-1B visas remains restrictive, Canada's Global Talent Stream and U.K. Tech Nation Visa programs increasingly attract top-tier professionals who previously considered the U.S. their first-choice destination. In response, U.S. states like Massachusetts and Illinois are lobbying for regional mobility pilot programs, and some employers have shifted toward remote-first models that allow hiring from Canada and LATAM under U.S. contracts.

As the competition for experienced tech talent intensifies, companies increasingly invest in early-career hiring strategies that tap into universities, coding boot camps, and alternative credentialing programs. In 2025, the success of a city's tech ecosystem is as closely tied to its academic pipeline as it is to its industry presence.

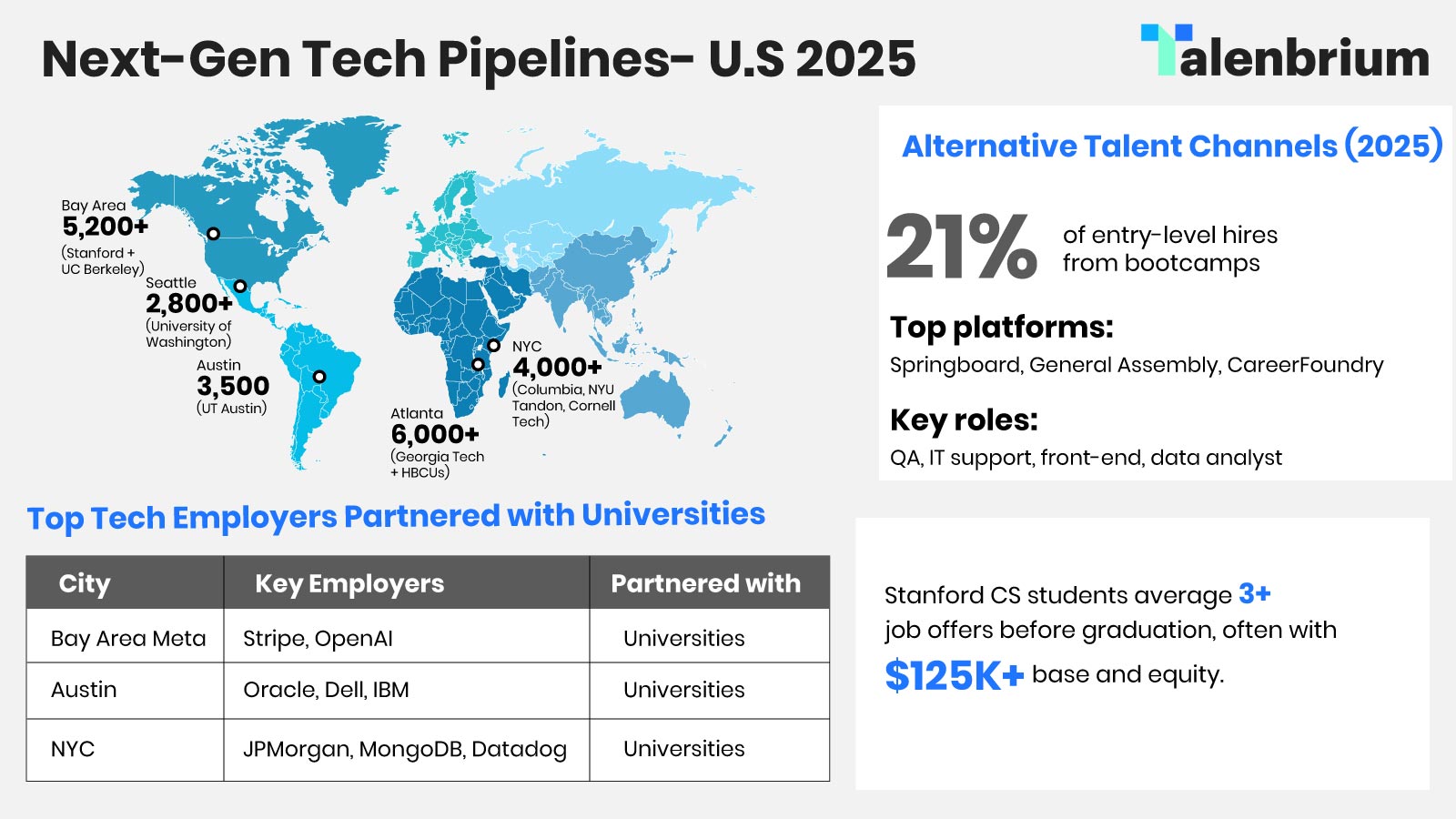

In the Bay Area, Stanford University and UC Berkeley remain two of the most influential talent feeders in the world, producing a combined 5,200+ CS and engineering graduates annually. These institutions deeply integrate with Silicon Valley firms, often embedding students directly into product and AI teams via co-ops and internships. The average Stanford computer science student receives 3+ full-time offers before graduation, many with base salaries above $125,000 and equity.

Austin benefits from the University of Texas at Austin, which produces approximately 3,500 CS and MIS graduates per year. The university has strong ties to Oracle, IBM, and Dell, and its Turing Scholars Program is increasingly viewed as one of the top undergraduate CS tracks in the country. Employers in Austin frequently hire from UT's freshman-to-full-time pipeline and invest in capstone projects that double as long-form technical interviews.

New York City is anchored by a triad of elite institutions — Columbia University, NYU Tandon, and Cornell Tech — all of which emphasize AI/ML, data privacy, and fintech engineering. Combined, they graduate over 4,000 CS and data science students annually. These schools are tightly aligned with employers like JPMorgan, Meta, MongoDB, and Datadog. Bootcamps such as Flatiron School and Recurse Center also majorly create job-ready junior developers, particularly for front-end and DevOps roles.

Atlanta is emerging as a university-driven ecosystem. Georgia Tech, one of the most extensive CS programs in the country, graduates over 6,000 students annually, many of whom specialize in AI, cybersecurity, or robotics. The school's online MSCS program has broadened access and enabled companies to upskill their teams internally. Additionally, HBCUs like Spelman and Morehouse feed top-performing Black engineers into entry-level roles across Delta, Mailchimp, and Microsoft's Atlanta campus.

Seattle continues to rely on the University of Washington, which each year produces more than 2,800 graduates in computer science and related fields, many of whom go straight to work for Microsoft and Amazon. The university also spearheads multidisciplinary computer science degrees, such as health tech and computational linguistics, which fit in nicely with Seattle's expanding healthcare IT market.

Outside of the conventional academic, alternative education providers are transforming access to tech roles. Platforms like Springboard, General Assembly, and CareerFoundry are placing thousands of graduates into IT support, QA, front-end, and data analyst roles annually. In 2025, an estimated 21% of all entry-level software engineering hires in mid-market companies come from non-traditional programs — a figure that is expected to grow.

In the aftermath of the 2023–24 tech correction, sentiment among U.S. IT professionals has evolved. Gone are the days of hyper-optimism and a "growth at all costs" culture. Instead, today's tech workforce is more pragmatic, feedback-driven, and values-aligned, with clear expectations around flexibility, learning, and well-being.

Across significant tech hubs, average sentiment scores—are based on platforms like Glassdoor and Levels. FYI, Comparably and Blind—have stabilized at moderate-to-high levels. Overall job satisfaction for U.S. tech roles in 2025 sits at 3.9 out of 5, while work-life balance scores are trending higher than pre-pandemic levels, especially in hybrid-friendly companies.

In San Francisco, the sentiment divide is stark. Employees at AI-native startups like OpenAI, Anthropic, and Scale AI report high engagement and excitement but also flag burnout risks and unclear career progression. Large companies like Google and Salesforce have seen slightly improved morale post-restructuring, driven by internal mobility programs and stock price rebounds. Still, sentiment data shows rising anxiety among junior engineers, particularly around visibility, mentorship, and layoff fatigue.

Austin shows above-average sentiment around flexibility, wellness, and company culture. Engineers consistently rate mid-sized companies like Atlassian, BigCommerce, and CrowdStrike higher than their Big Tech counterparts. Many employees cite greater autonomy, faster promotion cycles, and access to executive leadership as drivers of satisfaction. However, compensation scores have dipped slightly, with concerns about equity dilution and slower salary growth compared to the coasts.

In New York, sentiment is bifurcated between traditional finance and product-focused tech companies. Engineers at JPMorgan, Bloomberg, and Goldman Sachs value career stability and strong L&D investments but give lower scores for innovation pace and internal tooling. In contrast, employees at fintech companies like Ramp, Datadog, and MongoDB express high satisfaction with team culture, speed of execution, and remote/hybrid flexibility—though some express concerns about pressure-to-perform dynamics.

Atlanta is one of the most optimistic tech markets, especially among early-career professionals and underrepresented talent. Companies like Mailchimp, Calendly, and NCR receive high scores on inclusion, manager support, and work-life balance. The regional culture — a mix of Southern hospitality and technical ambition — has created a more sustainable work environment, though compensation and upskilling opportunities still lag compared to more mature tech ecosystems.

Seattle, anchored by Amazon and Microsoft, shows improving sentiment after two years of turbulence. Amazon engineers report better internal clarity and work prioritization following organizational reshuffles, while Microsoft employees continue to rate Copilot and AI transformation teams as top tier in terms of innovation and visibility. Still, many respondents cite "big company stagnation" as a concern, particularly among mid-level ICs (individual contributors) seeking faster career movement.

Scope of Research: U.S. IT Hiring Outlook 2025 – Strategic Executive Summary

Austin, Raleigh, Denver, and Atlanta are rising fast due to affordability, talent growth, and supportive local policies.

AI/ML, cloud, cybersecurity, DevOps, and backend development roles are the most in-demand nationwide in 2025.

San Francisco and New York offer the highest salaries, while cities like Austin and Atlanta offer competitive pay with lower living costs.

Atlanta, Austin, and San Francisco show the highest pressure, with demand far outpacing local talent supply.

Leading companies offer equity, wellness stipends, flexible PTO, learning budgets, and remote-friendly policies to attract and retain talent.

Top universities like Stanford, Georgia Tech, and UT Austin provide thousands of CS graduates and fuel regional tech ecosystems.

Cities like New York and Atlanta lead in gender and ethnic diversity, while others are gradually improving representation through DEI initiatives.