ICT Job Market Summary

The IT industry is rapidly undergoing massive transformation due to the advent of AI, changes in workforce planning, altering demands for technology across other industries among various other reasons. This is consequential to the hiring trends in the job market for labour market analysis within the IT industry and its subsidiary industries. Furthermore, the increase in security threats and data breaches across all industries have spiked up the demand for Cybersecurity professionals along with AI developers and ML Engineers.

Global ICT Talent & Labor Market Analysis

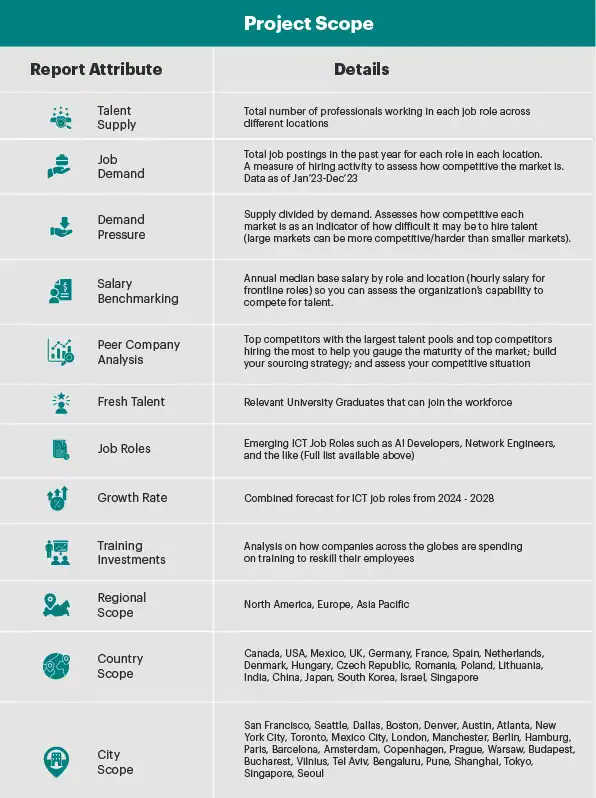

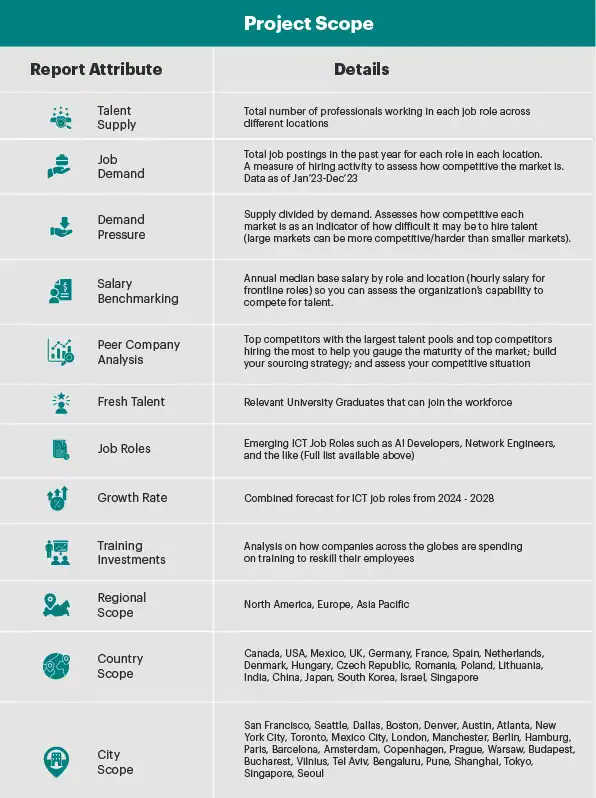

Our report focuses on the talent supply, talent demand and overall labour market analysis along with salary benchmarking and job postings across major cities globally that have either established ICT industry or are emerging as key players in the expansion of the industry. We have shortlisted these locations from across various continents to provide an in-depth analysis that will not only help understand the changing labour market dynamics but will also ideate reskilling strategies by some of the biggest players in the industry.

Artificial intelligence (AI) is the current technological innovation sparking hopes of rapid productivity gains and stirring fears of job loss. Using a fast-evolving suite of algorithms and statistical models – in particular, machine learning – increasingly available big data and falling costs of compute capacity, AI has made rapid advances in its ability to supply answers to problems where formal rules are impossible to codify, and where humans have until recently had a comparative advantage in inferring decisions from their training or past experiences. However, this change has also opened numerous job opportunities for various IT professionals.

So far, there is little evidence of significant negative employment effects due to AI. Empirical studies using cross-country variation in AI exposure, or studies using within-country variation by local labour markets, do not find any statistically significant decrease in employment. Similarly, recent surveys of workers and firms, or case studies of firms adopting AI, find few employment changes. However, AI is evolving rapidly, and advances in generative in AI may disprove some of the evidence accumulated so far. Despite their higher exposure to AI, high-skilled workers have seen employment gains relative to lower-skilled workers over the past ten years.

This may be because AI creates new tasks and jobs for workers who have the right skills, and this chapter does provide evidence that this reinstatement effect is prominent at this early stage of AI adoption in production activities. Other reasons why the impact of AI on employment may so far have been limited is that adoption rates remain relatively low or that firms are reluctant to lay off workers in the short term and instead rely on natural attrition (e.g. retirement and voluntary quits) to lower employment. Firms may also need time to implement new technologies after adoption. Any negative employment effects of AI may therefore take time to materialise. However, the latest wave of generative AI may further expand the tasks and jobs that can be automated.

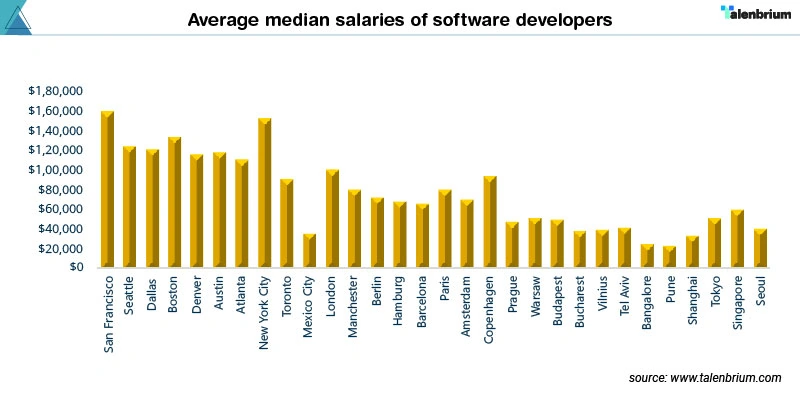

Along with labour supply and labour demand analysis, our report extensively talks about salary benchmarking, peer company analysis, fresh university talent supply and qualitative insight of recruitment trends, company strategies and the growth of AI across all industries. For companies to hire the right talent, the right salaries should be provided to the potential employee. Our report compares salaries for all the focus locations (mentioned below).

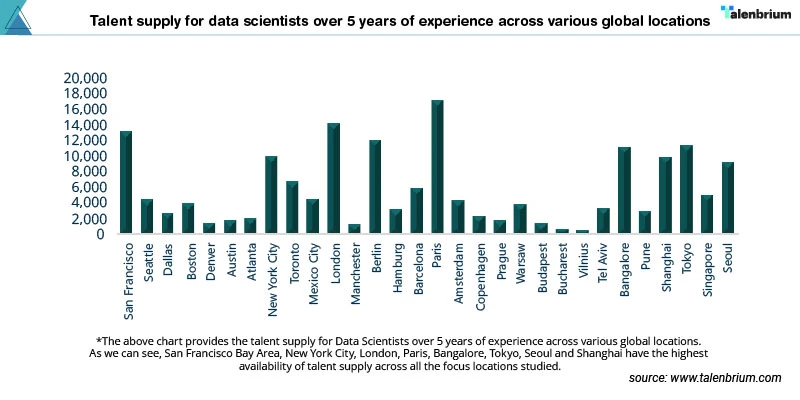

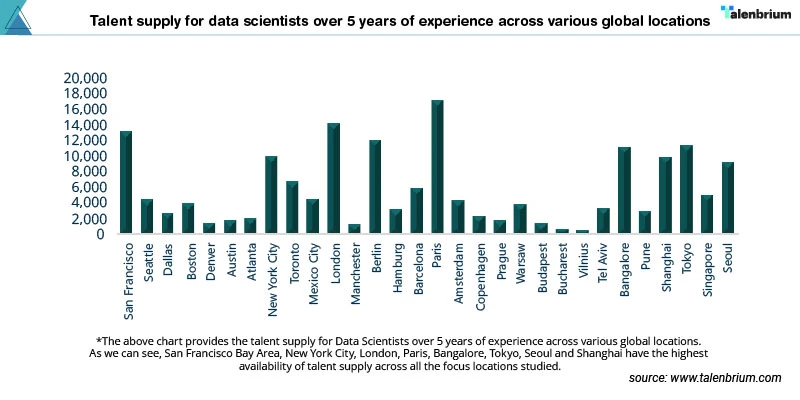

Talent Supply Analysis

US and India have the highest number of ICT professionals among. San Francisco Bay Area, New York City, Bengaluru have some of the highest tech talent supply in the world. Cities like Atlanta and Toronto have a large emerging tech talent competing with the major IT hubs of the world. European cities such as London, Paris and Berlin have a large established tech talent for all job roles studied (Cyber Security Specialists, AI/ML Engineers, Software Developers, Blockchain Engineers to name a few). However, East European cities are expanding their reach in the industry with cities such as Budapest, Prague and Bucharest housing large tech talent and multi-national companies.

Get Your Discounted Quote Today

Job Demand Analysis

Demand for tech talent has witnessed a rise after a stagnation during FY2021-22 globally. Toronto, Shanghai, Atlanta, Seoul, Pune have seen steady growth in job demands across various IT roles but particularly AI and ML engineering roles. The automation of auxiliary industries requires more tech talent which has increased the demand for jobs across multiple industries raising the average salaries in multiple IT hubs of the world. Bucharest and Vilnius have also seen a growth in job demand for IT related roles. East Europe is slowly attracting quality tech talent from all over Europe and middle east.

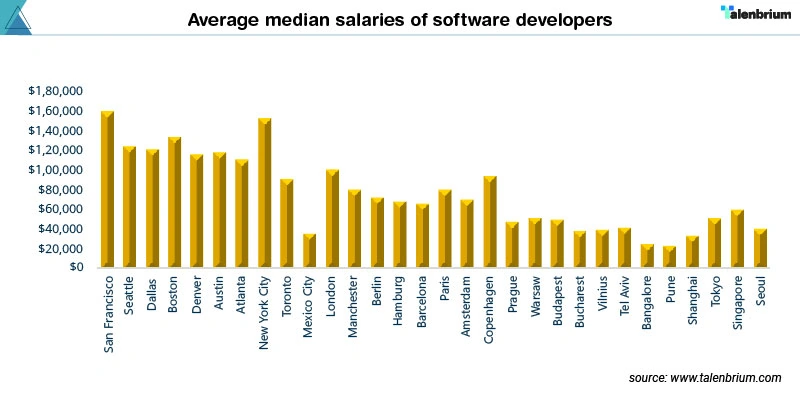

Salary Benchmarking

New York City and Bay Area have some of the highest median salaries for all the job roles combined. The high wages are a deterrent for companies to expand their operation in these locations, but the availability of a quality tech talent pool enables these locations to be in the forefront. The high costs of living, high office rental spaces are some of the reasons why salaries have been drastically increasing year on year. But with the advent of globalisation and the expansion of tech talent in APAC, companies have alternative locations to expand their operations and hire quality talent. Bengaluru has been often termed as the Silicon Valley of India with a surplus of IT professionals. These professionals can be hired at 1/5th the average salary provided to those in New York, San Francisco, or London. Bucharest and Budapest in East Europe has witnessed steady growth in the sector with relatively lower salaries. As an example, below is the snippet of average median salaries of Software Developers.

Request for a Free Extract

University Analysis (Fresh Talent Supply)

Companies are often looking at graduate training programs and fresh talent to join their organizations. These graduates bring with them fresh ideas and newer approaches of work ethos. It is hence essential for companies to hire the right talent from quality and esteemed universities across the globe to join the ICT labour market. Locations chosen in this study cover the list of esteemed universities from where fresh talent can be recruited. Some of the examples of such universities include Queen Mary University in London, NYU in New York City, FU Berlin, IITs in India and many more.

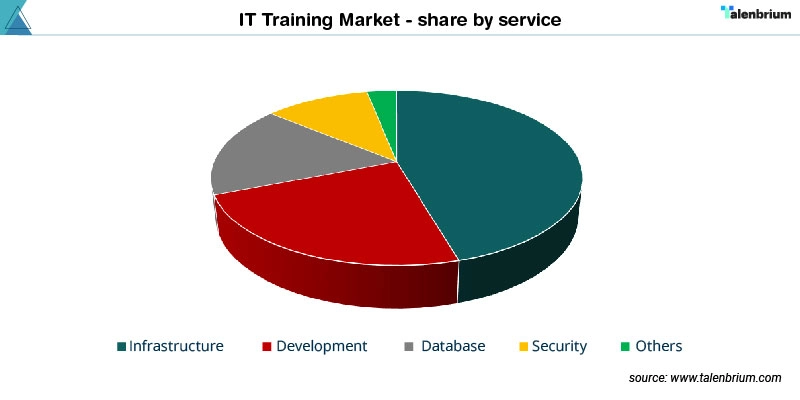

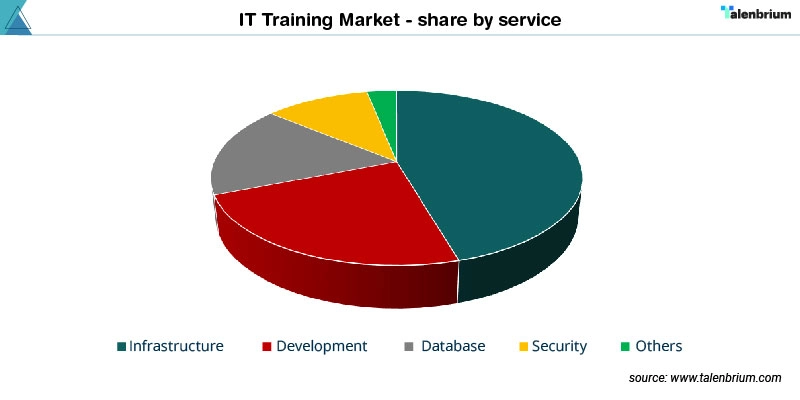

Information Technology (IT) Training Market 2024-2028:

The Information Technology (IT) Training Market size is estimated to grow at a CAGR of 7.03% between 2023 and 2028. The market size is forecast to increase by USD 12.93 billion. The growth of the market depends on several factors, including the growing number of partnerships and acquisitions, the increasing popularity of e-learning across organizations and the rising demand for professionals skilled in emerging technologies. IT training refers to business-to-consumer (B2C) and business-to-business (B2B) training offered by professional organizations/enterprises. The scope of the review includes application development and programming training, IT infrastructure, networking and cloud computing, cybersecurity, and database and big data.

Personalize the Report to Your Specific Needs

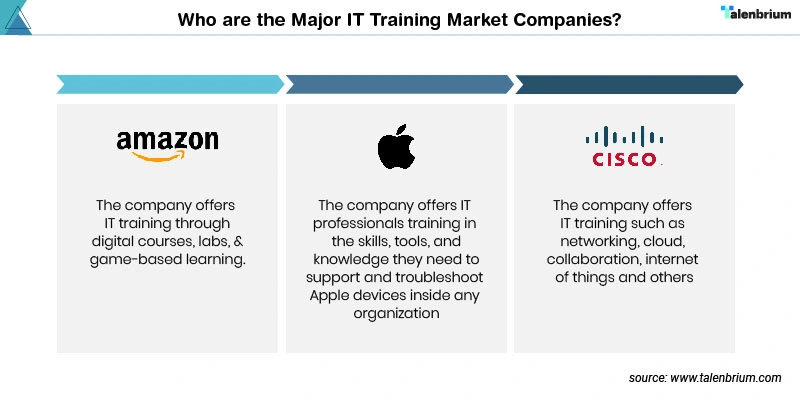

Who are the Major IT Training Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amazon - The company offers IT training through digital courses, labs, and game-based learning.

Apple. - The company offers IT professionals training in the skills, tools, and knowledge they need to support and troubleshoot Apple devices inside any organization.

Cisco - The company offers IT training such as networking, cloud, collaboration, internet of things and others.

Other major companies that provide innovative and alternative ways of training include the following:

- ACI Learning

- Allen Communication Learning Services

- British Standards Institution

- CBT Nuggets LLC

- Computer Generated Solutions Inc.

- Dell Technologies Inc.

- ESET Spol Sro

- ExecuTrain

- Firebrand Training Ltd.

- Hewlett Packard Enterprise Co.

- ILX Group

- International Business Machines Corp.

- Learning Tree International Inc.

- LearnQuest Inc.

- Microsoft Corp.

- New Horizons Computer Learning Centers Inc.

- Oracle Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Frequently Asked Questions: ICT Industry Global Labour Market Analysis