BFSI Job Market Summary

The labour market and human capital trends in the Banking, Financial Services, and Insurance (BFSI) industry across the US, Europe, and the UK in 2023 show varied but interconnected developments, primarily influenced by technological advancements, demographic shifts, and the lingering effects of the COVID-19 pandemic. In the BFSI industry, a significant trend is the shift towards digital and immersive solutions, driven by technological innovation and changing customer demands. Despite facing uncertainties and challenges, BFSI institutions are adapting by focusing on becoming experience-driven businesses. This move towards digitalization is a response to the disruption caused by the pandemic and is set to shape the industry in 2023 and beyond. Labour Market Trends in the UK The UK labour market is experiencing long-term trends such as an aging population and a shift towards jobs that require higher education, are service-oriented, health-related, digitally enabled, or technology-focused. These trends are creating persistent skills shortages, as education and training are not keeping up with the demand for these new skill sets. Our report thus provides a comprehensive analysis of where to look for talent, both experienced and university graduates. We provide a list of relevant universities where companies can hire talent from.

Key Hiring Trends in the BFSI Industry

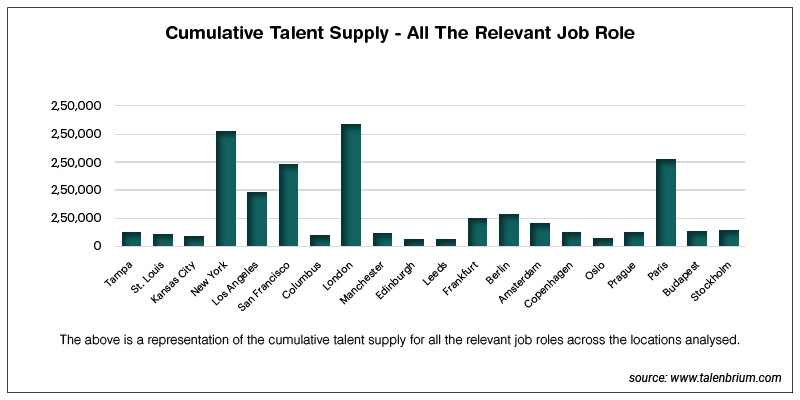

Talent Supply: The report provides the total number of professionals working in focus job roles across locations. New York City, London and Paris boasts many professionals working in key job roles. New York City hosts ¬16,000 Risk Analysts and ¬42,000 Financial Analysts whereas London hosts ¬19,000 Risk Analysts and ¬48,000 Financial Analysts. However, upcoming locations such as Leeds and Tampa hosts lower number of professionals but have witnessed steady growth in the number of focus talent with a CAGR of 5.6% and 4.1% growth respectively annually over the last 4 years.

Request for a Free Extract

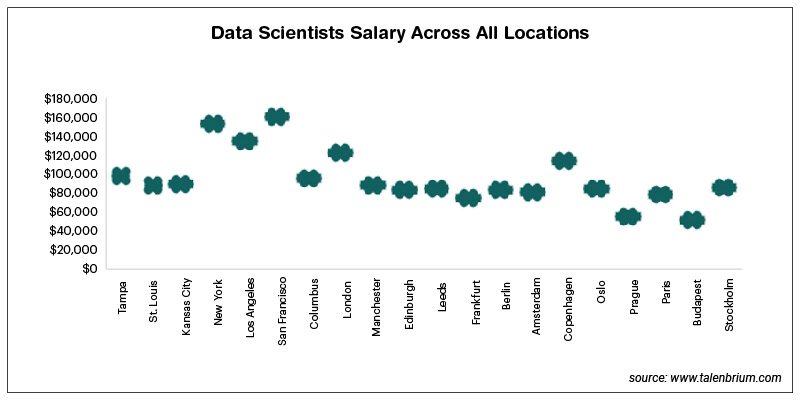

Salary Benchmarking: Organizations are not only looking at the high-cost financial hubs of the world but have also shifted their focus to relatively low-cost locations such as many Eastern European cities such as Prague and Budapest. These locations not only boast quality talent but are also reasonably cheaper to hire talent. The average analyst in Prague needs to be paid ¬$50,000 per year which is less than half or at times 1/3rd of what an average analyst earns in New York City and London. Hence, there has been a shift to these locations. Further, even for tech talent within the BFSI space such as Software Developers and Network Engineers in San Francisco Bay Area, Paris and New York earn an average of over ¬$125,000 where as hiring these talents even in cities like Amsterdam, Frankfurt and Oslo is much cheaper with an average of ¬$80,000-$100,000 annually.

Data Scientists and Cyber Security Analysts on an average earn the highest median salary across all locations.

Personalize the Report to Your Specific Needs

Job Demand: Along with providing talent supply and median salaries, our report also provides in detail the jobs posted over a period (the last quarter, half year or the entire year). This parameter not only helps us understand the number of jobs posted and the expansion plans of various companies, it also helps us understand the demand pressure (job demand/talent supply). The higher the demand pressure, the less favourable the location is due to high competition which also drives up the median salary of a location. Bay Area and Berlin have over ¬30% demand pressure for tech roles, where as New York and London have high demand pressure for core finance roles. However, Tampa, Amsterdam, Budapest, and Manchester have witnessed high demand for core finance roles (over¬25% average for all core job roles combined) over the last one year.

Skill Growth: As per our research, we have noticed that the BFSI industry is hiring talent with varied skill sets ranging from core finance which requires a working knowledge of IFRS9, BASEL accounting standards to more core tech related jobs roles such as Software Developers and Network Engineers. This has been the on-going trend for over 5 years now where more tech workers are joining big BFSI organizations. Thus we have seen a growth in the skill sets within the industry. Our report talks about the growth of such skills within USA and the UK.

Fresh Talent Analysis: Besides the above-mentioned key parameters our report studies the availability of fresh talent by focusing on the presence of universities and the courses offered that our potential clients/relevant companies can hire from. For instance, New York is surrounded by many prestigious universities such as NYU, Columbia University, SUNY to name just a few. Other locations such as Oslo houses reputed universities such as University of Oslo, BI Norwegian Business School, and many others. We have extensively mentioned about top universities and colleges that offer relevant courses in core finance and tech roles for all the focus locations. Berlin and Frankfurt in Germany houses some of the most prestigious as well as up and coming universities that companies can hire from to meet the required talent demand.

Drivers of the BFSI Industry

- Macroeconomic Factors: Companies are looking out for new revenue generating models and reduce operating costs, enhancing the efficiency of the capital provided.

- Digitization of the Industry: Financial institutions are enabling newer ways of adopting potential technologies such as automation, hybrid cloud and AI They are driving digitization across internal business units and across their ecosystem of external partners while ensuring security and compliance.

- New Talent and Work Locations: Apart from core finance talent, such as Finance and Investment Analysts, companies are also hiring tech-driven talent such as Cyber Security Analysts and Network Engineers moving with the times of digitization of the industry. In doing so, companies are also expanding their office space to locations they earlier did not have office space in.

- Security and Fraud: Even though banks and other financial institutions are inculcating new ways to serving their customers by automating, they are also creating new opportunities for security breaches and frauds. Hence, organizations are hiring tech talent professionals such as Ethical Hackers and expanding their risk management teams to deal with such issues.

Geographic Trends

Major financial hubs of the world such as New York City, London and Paris continue to attract large talent from different parts of the world. However, the pandemic proved that flexible working can be equally efficient and hence large number of talents can now work from low-cost locations. There are multiple benefits to it for both the employers and the talent. Expanding office spaces in upcoming locations such as Greater Tampa, Columbus, Leeds can be less expensive for the companies (both in terms of leasing properties as well as giving a relatively lower average median salary). Further, employees can work from their convenient locations with lower costs of living. Hence, our report not only covers the major financial hubs of the world but also upcoming, low-cost locations.

Get Your Discounted Quote Today

Competitive Analysis:

We provide the presence of some of the top hiring companies in each location along with their presence in terms of the current headcount. Below is a small snippet of the companies present across our focus locations.

Scope of the Report:

- The talent supply data is as of Q3 2023, the job demand data is from Q3 2022-Q3 2023.

- The locations studied in the report are: Tampa, Columbus, Kansas City, New York City, Los Angeles, St. Louis, San Fransisco Bay Area, London, Manchester, Edinburgh, Leeds, Frankfurt, Paris, Berlin, Amsterdam, Prague, Budapest, Oslo, Stockholm.

- The job roles studied are: Portfolio Manager, Risk Analyst, Investment Banking Analyst, Financial Analyst, AI Developer, Risk Manager, Finance Manager, Cyber Security Analyst, Data Scientist, Financial Planner, Robotics Engineer, Software Developer, Network Security Engineer, Ethical Hackers

Key Coverages of the Report

- Global Labor Coverage: Includes verified data from over 90% reliable global GDP sources and authorities and sets us apart from other reports that rely on self-reported or limited data, and unverified sources. A broader and confident approach offers a truly international perspective on talent trends and sets our offerings apart from that of others.

- Granular Insights: The report coverage extends beyond basics such as salary data and provides insights into crucial aspects including skill demand, talent supply, competition, and employer brand sentiment across geographies and a range of industries.

- Predictive Analytics: Use of historical data and statistical algorithms enables predicting future trends or outcomes, and helps HR and organizations to anticipate workforce needs and provide approaches to address issues before any arise.

- Actionable Recommendations: Serves up insights and tailored suggestions to address HR needs, devise specific strategies for recruitment, retention, development, and plan initiatives to develop and promote diversity at the workplace.

Why should Talent Acqusition Executives Buy This Report?

- Data-driven Decision Making: Provides factual evidence to support talent management decisions, reducing unreliable decision-making and potential bias.

- Improve Talent Acquisition: Aids in identifying skillful and relevant talent pools, optimizing sourcing strategies, and benchmarking hiring performance against that of competitors.

- Enhance Employer Branding: Helps to understand candidate as well as employee perceptions of the company, identifies areas for improvement, and strengthens employer value proposition.

- Optimize Compensation & Benefits: Helps in offering benchmark compensation packages as per industry standards and regional trends, thus ensuring competitive packages while controlling the costs.

- Support Workforce Planning: Helps HRs to plan and organize for future skill requirements, identify potential skill gaps, and accordingly design targeted and customized training programs.

- Drive Diversity & Inclusion: Helps analyze varied talent pools, optimize candidate sourcing strategies for underrepresented groups, and set achievable Diversity, Equity, and Inclusion (DEI) goals.

- Stay Ahead of the Curve: It can aid in gaining valuable insights into key emerging talent trends, competitors’ strategies, and ever-evolving labor market landscape, thus allowing HRs to be proactive and ahead of the competition.